James Meeston of Saltydog Investor charts the markets

Fifty years ago, our chairman, Douglas Chadwick, was the navigator on a Jamaican banana boat plying between the UK and Kingston, Jamaica. In the hurricane season, the most important thing to have was regular accurate information on any storm’s speed and direction.

Such information was supplied by the American coastguard who flew their planes into the eye of the storm and kept him informed of any storm’s progress. Armed with this information he would do everything to try to keep the ship safe in the south-west quadrant of the storm. This is the safest quadrant, as in theory the storm will run away to the north leaving you free to continue safely to your destination.

The lesson here was that if you have accurate continuous information you do not have to let circumstances do what they will with you.

Charting the markets

When Douglas Chadwick first started following the performance of unit trusts it became clear that the most important thing was to pick funds that were investing in areas that were doing well. Back then Japan was booming, although it was overtaken by the rest of Asia through until 1997. There then followed the tech bubble through to 2000. Subsequently we have seen a boom in property, commodities, China, emerging markets and more recently corporate bonds.

IMA sectors

So how do you know which areas are doing well, and which funds are investing in them? Fortunately, it’s not difficult as most of the work has already been done for you. The Investment Management Association (IMA) has defined over 30 different sectors and most funds in the UK fall into one of these sectors. The qualification rules for each sector are pretty rigid.

As the funds have to work within tight constraints it’s hardly surprising that when a sector is doing well most funds in that sector will benefit. It is equally true that when a sector is suffering even the best fund manager will struggle. Take the UK Equity Income Sector: Historically the banks and the oil companies have paid good dividends, and so were favoured by UK Equity Income fund managers. After the credit-crunch, the banks had to sort out their balance sheets and dividends were slashed. In 2010, there was an explosion on the Deepwater Horizon Rig which was owned and operated by Transocean but drilling for BP. The explosion caused the rig to burn and sink, resulting in a massive oil spill in the Gulf of Mexico. BP had to foot the bill and so suspended their dividend. It’s not hard to see why the UK Equity Income Funds were having a tough time. The banks and BP would have been core holdings for all funds in the sector.

Managing risk

Understanding the sectors also allows you to pick funds that suit your appetite for risk. Equities often give the best returns, but have historically been the most volatile. If markets are falling, or you’re looking for a safer option then bond and gilt funds might be the place to look. For a combination of the two there are the mixed investment funds. When protecting your investment from the ravages of a storm there’s nothing wrong in reverting to cash either. It’s important to have a disciplined approach to managing risk because, if left unchecked, you can easily drift into a position where your investments do not match your tolerance to risk – more on this another day.

Tracking performance

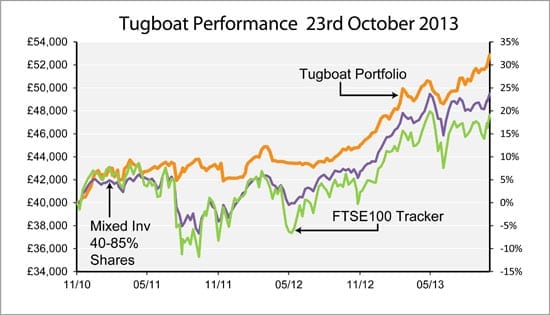

There are plenty of pundits willing to predict the future but, the last 5 years has proved just how unpredictable investing can be.

At Saltydog Investor, each week we produce up to date information on how each sector is performing, whether it’s going from strength to strength or starting to decline, and ideally sorted in a way that easy comparisons can be made.

After the sectors are identified, one only has to pick the funds.

For more information on about active investing and managing your own money from Saltydog click here. Follow Saltydog on Twitter @saltydoginvest.

Subscribe to our free once daily email newsletter here: