Saltydog’s James Meeston suggests that staying active is good for your wealth

So you have made the decision to become a DIY investor and manage part or all of your ISAs, SIPP and other financial investments. Well, one of the first choices you must make is whether you are going to be a “passive” or “active” manager of your portfolios.

As a passive investor life will be quieter as you will select the sector that you believe has long time growth potential and then simply select the fund manager, his fund, and step in for the long term. If you get it right, and the sector selection is good and stays good, then this will work. However it’s a big “if” as the investment world changes rapidly and what was once good frequently turns sour. That is why many billions and billions of investors’ money is sleeping peacefully and undisturbed, slowly sinking into the financial equivalent of the Marianas Trench.

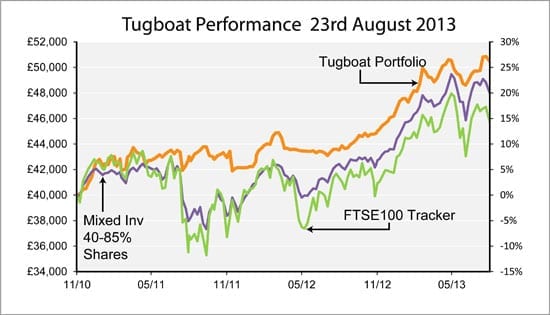

I’m a great believer in “active momentum” investing and am certain that money is made by buying funds that are in sectors on the rise and then selling them when the sectors start to sink – as they surely will at some time. However, to be successful at this manoeuvre you must have access to a constant supply of up to date fund and sector performance. Working on what happened one, three and five years ago just does not cut the mustard. That’s why we set up the Saltydog Investor, where we analyse both fund and sector performance on a weekly basis.

Jesse Livermore

Wouldn’t it be nice if investing could be reduced to a simple set of rules? Well, at the turn of the last century an American called Jesse Livermore did just that, and became one of the most successful investors in history. He was born in 1877 and in 1929 was worth over $100 million, equivalent to $4 billion in today’s terms. He was a momentum trader. Here are some of his rules and sayings:

- “The game of financial speculation is the most uniformly fascinating game in the world. It is not for the stupid, the mentally lazy or for the get quick rich adventurer. They will all die poor”.

- “Never trust your own opinions, and back your own judgement, until the actions of the market first confirm these opinions”.

- “Don’t trade when there are no obvious opportunities. There is nothing to be lost in holding cash”.

- “Cut your losses, but let your winning positions run”.

All of this makes sense if you have access to up to date numbers, and you are operating on a cheap trading platform with a plentiful supply of funds. This is all available in this modern world of computers and the Internet.

Don’t break the rules

It is easy to fall into some obvious traps. The God complex is one which can occur after a run of success, when you start to believe you know more than the market. The reality is instead that “markets are never wrong, opinions often are”.

Another misconception is that you fall in love with your funds and don’t remove the failures. What makes you so sure that they will recover?

Jesse Livermore summed both of these premises up in the saying:

“A loss never troubles me after I take it. I forget it overnight. But being wrong – not taking the loss – that is what does the damage to the pocket book and to the soul”.

Another problem can happen when you only want to invest in your home market. That could rule out a new emerging market coming on song. So, look outside the bars on your cage and stay alert to opportunities wherever they may occur.

Finally, it is necessary to control your tribal instincts. Being one of the herd may make you feel safer from the predications of the approaching lions, but remember the best part of the grass has gone by the time the rear of the herd gets to feed. So you must use the numbers and be confidently active.

What data do I need?

Jesse Livermore traded in stocks and shares, where he needed a detailed understanding of individual companies. I prefer to invest in funds where the analysis is more straightforward. The majority of UK based funds are members of the Investment Management Association (IMA), who allocate funds to specific sectors. These sectors are tightly defined and control the aims of funds and dictate what they invest in. The sectors that are doing well at any one time is determined by external factors – i.e. what’s going on in the big wide world. I start by tracking the relative performance of the IMA sectors; once I’ve determined which ones are doing well picking the funds is easy.

Misplaced loyalty

There are many people in the industry who will tell you that momentum investing is wrong and you cannot follow the market and be successful. You should try telling that Jesse Livermore and the Rothschilds who all made a reasonable living out of doing just that. The financial industry would like a quiet life where they are the ones making the money. It was once said to me by a fund manager that if I made an investment in his fund then I owed him loyalty and should stay invested with him irrespective of its performance. Oh really? I don’t think so. He was a perfect case for the reintroduction of walking the plank.

For more information on about active investing and managing your own money from Saltydog click here. Follow Saltydog on Twitter @saltydoginvest.

Subscribe to our free once daily email newsletter here: