Richard Webb of Saltydog Investor shares his views on the new investment world and DIY investing

Leaving your investments to the so-called professionals is like embarking on a round the world voyage using the stars to navigate and allowing the winds to dictate your course. Managing your own investments without proper information is a similar such voyage.

For too long the financial industry’s focus has been on maintaining funds under management and therefore the preservation of recurring income rather than on returns to you, the end user.

Of course there are a lot of people will merrily pay anything up to 1% of their investments to their adviser each year in return for an annual review meeting, a cup of coffee and a reassuring investment cuddle during which you can wonder why you feel slightly miffed after being told that, all things considered, your funds have really done quite well considering the difficult market conditions. You’ll be told that you need to “be patient with the selected funds” and “allow the full market cycle to run its course”. Depending on whom you speak to this could be anything between five and fifteen years.

This patience doesn’t come cheaply. Never fear though, because apparently if you are consistently average for long enough then you will (eventually) come out on top (so the mantra goes).

It is frequently reported that many tens of billions are left floundering in underperforming “balanced managed” or “mixed” funds offered by some of the world’s largest financial institutions. In my view, there has to be a better way of investing money and for those with a degree of knowledge, a little time and effort there is.

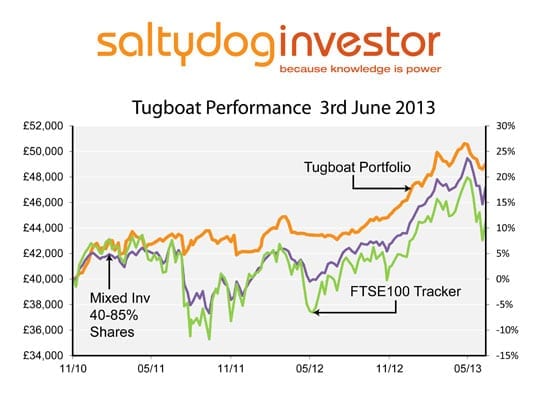

Over a long period of time the chairman of Saltydog, Douglas Chadwick, reviewed the funds he had invested in on a monthly basis – for that was as often as the data was available. It became apparent that not all markets declined at the same time or at the same rate. When some sectors were down, there were others that were really doing quite well. Being in the right sector at the right time was by far the most important thing and, as has become increasingly more common knowledge, investors can switch ever more easily and readily. You don’t have to be the last one off the sinking ship.

It is possible to deliver better returns through being active, by investing in those areas that are doing well in the here and now, by knowing and understanding when to cut those “dog” funds loose, by monitoring closely the readily available data and acting on it without compromising and taking unnecessary investment risk.

Active or momentum investors espouse an investment strategy which goes against the advisory grain and increasingly more and more investors want to take control of their affairs. Before taking control though, investors must be aware of the range of variables that confront them when being active, notably:

– Understanding risk

– Sectors

– Funds

– Investment platforms

– Costs of investing

– Where to look for information on different investment funds

– How to switch between funds

– Common investment mistakes

The financial industry blinds us all with jargon and acronyms such as CDS (credit default swaps), LIBOR (London Interbank offered rate), TER (total expense ratio) and RIY (reduction in yield) maybe in an attempt to convince us that we need them more than is actually the case. Over the coming weeks we will be looking at and exploring those areas that are essential to making good, robust investment decisions and sharing with readers the keys to DIY investment success, helping you make sure that your portfolios are not holed below the waterline.

A cursory glance at many investment publications sees the same old names trotted out, and in some cases the funds have impressive track records over sustained periods of time, but why would an investor stick with a fund when it is doing badly on the basis that it has a good long term performance. Think by how much returns could be improved if much of the negative performance was avoided. By all means pile in to a fund when it is riding the crest of a wave but when that wave breaks it is time to head for port.

There is a wealth of data available to determine what the next move should be. The last five years have been a lesson in investment volatility and at times to the casual observer it may have looked as if investing is a lottery. It does not have to be. Reviewing investment decisions and holdings on a monthly basis would be a massive step change for huge swathes of investors, many of whom make changes from one year to the next. For even low risk investors it is not difficult to make good positive returns when others may feel like they are losing their shirts.

The message is that DIY does not have to mean RIY, quite the opposite. With the right tools, the right charts, the right information and mind set investors will see that they don’t have to be Amerigo Vespucci to navigate successfully in this new investment world.

For more information on about active investing and managing your own money from Saltydog click here. Follow Saltydog on Twitter here.

Subscribe to our free once daily email newsletter here.

Excellent addition. So much data out there showing the cost of City advise is significantly higher than the added value it offers. Great article.