HMRC publish a list of tax evaders but neglect to mention any large corporations

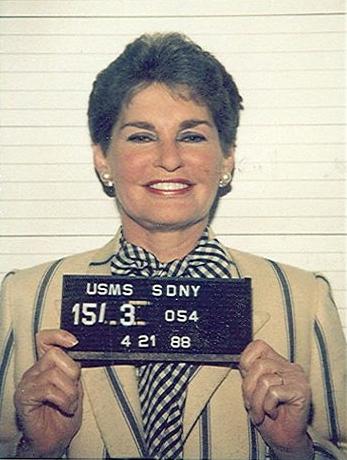

The hotelier and real estate heiress Leona Helmsley stated: “Taxes are only for the little people” before being convicted of income tax evasion in 1989.

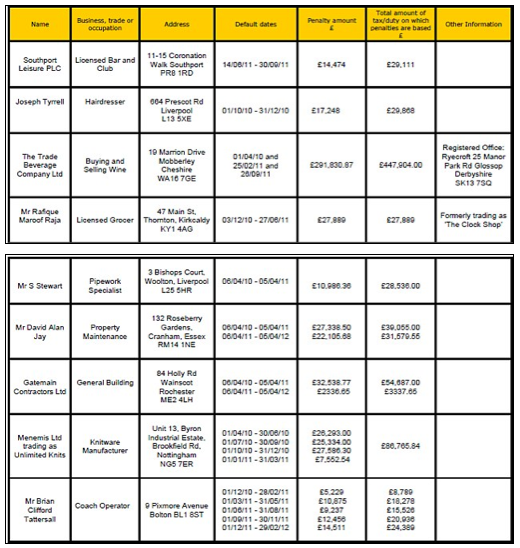

Yesterday, Her Majesty’s Revenue and Customs published a list of names and addresses of nine individuals and companies who they describe as tax defaulters. Amongst the names on the list are a grocer, a hairdresser and a coach operator and the amounts owed range from £29,111 to £447,904.

In response, Richard Murphy of Tax Research called the list of names: “Plain, straightforward hypocrisy”. He went on to state:

“The people named are easy targets. There are clearly different categories of tax crime, with small businesses who put cash in HMRC’s pockets named and shamed; but banks, wealthy lawyers and global corporations offered anonymity. It seems that only little people pay tax and only little people are named and shamed”.

Mr Murphy is quite right. Whilst these people may owe the taxman money, their activities are not in the league of the tax avoidance strategies of Starbucks, Google and Amazon.

If HMRC don’t want to be placed in the same category as Leona Helmsley, they’d do well to change their ways. Instead they’d do better to focus on the true “aggressors” that David Cameron highlighted this week but sadly, that would probably just be too logical a strategy for this monolithic organisation to follow.

View the HMRC list of 9 defaulters at: http://www.hmrc.gov.uk/defaulters/defaulters-list.pdf

For a profile of Leona Helmsley, go to: http://thesteepletimes.com/tycoons/leona-helmsley-1920-2007/?position=14

Publishing those names is a disgrace. I am appalled. Perhaps the people have been ill and cannot do a tax return. There are all sorts of reasons why they may have defaulted on a tax demand, including being in dispute without the amount demanded, which could simply be an assessed amount.

This is an abomination. Petty lefties at it again. When will their jealous mental deficiencies be corrected? I agree with the Dark Avenger in that they may be ill or just financially incapable of any defense. With regards to the big boys instead of deflection and grumbling, the government should immediately change the company tax laws in order to net these leviathans of avoidance and put some real money back into the countries coffers if only to replenish after G.Brown’s horrendous gold sale!

This is nickel and diming on a grand scale for sure. The smaller man/woman/companies often run into genuine financial diffuculties and these begrudgers are sowing sour grapes. It could even be illegal under today’s information laws?

The real scourgers are the BVI schemes that enable UK tax avoidance for a large number of fund activities and real estate acquisitions. Many fraudsters are hiding behind those schemes , so it is not only a tax issue .

It is mind boggling that the UK gov is not finally ending this mockery oF tax justice and transparency.

The published list is just a populist distarction from the real issues that the Gov seems to eschew.